Most complaints people have with lawyers fall into one of four categories—and having more than one problem isn’t uncommon either. Here are the main areas of contention:

What is the role of insurance?

For a long time, men have been looking for a way to insure their belongings so that they do not lose everything in the event of a problem. And while it has undergone significant changes since its inception in 1700 BC, in Babylonian society, the role of insurance has not really changed. Insurance always aims to protect, despite the different forms of contracts that currently exist.

What is an insurance?

Simply put, insurance is a mechanism that allows a person (physical or moral) to protect themselves from the financial and economic consequences of the occurrence of a risk. Under the insurance contract , the insurer undertakes to provide a benefit to the insured upon the occurrence of a risk. The insured person agrees to pay a premium or a contribution.

In France, there are 3 types of organizations offering insurance services. They are governed by separate legislation:

- Insurance companies that are governed by the Insurance Code;

- Mutuals that fall under the Code of mutuality;

- Provident institutions that fall under the Social Security Code.

It should be noted however that the insurance world is not limited to insurers alone, many other actors work there: general agents of insurance, experts of insurance, brokers …

Classification of insurance

It is possible to classify insurance by taking into account several criteria of distinction. The most common classification is based on the obligations of the insurer at the time of the performance of the contract. Thus, there is:

- Non-life insurance in which the insurer must compensate the victim for the effects of a claim and offer compensation proportional to the cost of the damage. Within these insurances, it is necessary to distinguish between the insurance of things (compensation for damages that may be suffered by the property of a third party and cover the damage suffered by the property of the insured) and liability insurance (repair damage to others);

- Insurance of persons in which the insurer pays an amount the amount of which is contractually established at the time of the occurrence of a risk affecting the life of the insured or the subscriber. Such insurance can be divided into two subcategories: the life insurance (life insurance, insurance in case of life, endowment) and non-life insurance (health insurance, personal injury insurance).

The advantage of the distinction between non-life insurance and life and health insurance is that non-life insurance is based on a compensatory principle, while life and health insurance is based on a lump sum principle (enrichment).

The roles of insurance

In addition to protecting people, insurance plays a relatively important role in the economy because it makes business relations more reliable, reassures investors in the national economy and encourages investment.

The role of insurance is also social since the amounts paid to insured persons and beneficiaries allow them to maintain their income, safeguard their assets, reduce social security services, keep their jobs and Finally, to boost the economic fabric.

Insurance your mobile phone: how does it work?

When you buy a new smartphone, especially when it is expensive, a question may arise: should he ensure his mobile phone or not? If the phone is today one of the most used tools everyday, mobile insurance is still little known to the general public. What are the possible guarantees of a mobile insurance? What are the exclusion cases? What about the profitability of the investment? Here below is the basics to know and that will be useful to you about mobile insurance.

Mobile insurance: what does it cover?

We know that these little everyday objects are fragile and break quickly. This is especially true that they are handled almost all the time sometimes. This ceaseless manipulation also attracts the eye and especially that of the thief who can take your Android or your iPhone hands easily enough that it is run in the exercise. It is also quite common to see this type of techniques snatched in tourist places. What to think about the insurance of your good on these occasions and for the life of every day.

Breakage assured, is it possible today?

The breakage is the main reason that encourages a person to take out a mobile insurance . Indeed, at present, although phones are more sophisticated, they remain fragile products. A fairly large drop and the screens of some models can break or the shell crack. In these cases, the insurance can cover the damage provided that the breakage is due to an external event (an external cause to prove by all means).

Arras Insurance Blog invites you to think about the usefulness of taking out such insurance!

This means that if your phone has been damaged due to clumsiness on your part, you will not be compensated by your insurer. Things will be different if you have been jostled or pushed. The deadline to make a declaration of breakage of his mobile phone is 5 days. If you do not respect this deadline, your insurer is entitled to refuse to compensate you. It should be noted that the insurance does not cover damage that does not affect the operation of the phone.

Theft covered by your insurer

Mobile theft may be covered by insurance, provided the theft has been accompanied by an assault. Thus, to hope for a refund, you will have to attach a copy of the complaint that you filed with the police station to your declaration of loss. If it is a pickpocketing, compensation remains possible, but you will have to prove that there was no negligence on your part, something that is often difficult.

The most common exclusions

Like any contract, mobile insurance contracts can provide for various cases of exclusion. Here are the most common of them:

- The mobile insurance generally does not cover commercial and business phones;

- Your insurer will not compensate you if your mobile phone was stolen when it was in your vehicle. Likewise, if you have simply lost it (except external cause);

- Finally, mobile insurance does not intervene if your phone breaks down. For this type of problem, it is better to play your manufacturer’s warranty.

What about the profitability of a mobile insurance?

The main advantage of a mobile insurance is that it allows you to get compensation for your smartphone when possible (theft or damage caused by a third party). Nevertheless, the restrictions are sometimes numerous. In practice, it is really profitable to subscribe to a mobile insurance that during the first year and if your phone is particularly expensive (insurance without cap of compensation).

If you decide to insure your phone, take the time to read your contract in order to understand the main lines: guarantees, exclusions, deductible, ceilings of refund …

What is liability insurance?

According to the law (art 1240 of the Civil Code), any person involuntarily causing material, immaterial or bodily harm to another has the obligation to repair it financially: it is the civil responsibility . If a person has taken out liability insurance , it is this insurance that will intervene to compensate the victim of the damage. What do you need to know about the subject?

Liability insurance: mandatory or not?

In principle, taking out civil liability insurance is not compulsory . However, there are situations where it is necessary. Thus, those who own a car must take out liability insurance as well as tenants. Note, however, that even if the law does not require this insurance, it is a good protection measure to get away with damage to others. In fact, without insurance and in the event of an accident, it is you who will be responsible for paying compensation to the victim. And that can come back very expensive.

To exonerate you from your liability, you must then prove the existence of a case of force majeure or fault of the victim.

Insurance with different forms

As you will have probably understood, liability insurance is present in many contracts and can take many forms. For illustration, third-party car insurance, school insurance or the guarantee against rental risks are all civil liability insurance contracts .

Third-party auto insurance covers the damage you have caused to the third party when you are driving a vehicle. The school insurance for its cover damage caused by your child as part of the school.

It should be noted that there is a specific contract on civil liability: the private liability contract . It covers several damage to third parties:

- Damages caused by carelessness or negligence;

- Damage caused by your children

- The damage caused by your employees (person under your control);

- Damage caused by your pet or the one you have temporary custody of;

- Damage caused by your home or an object you own.

Liability insurance: the limits

Any contract with limits and a contract of civil liability insurance does not escape this principle. Thus, the civil liability guarantee always provides exclusion situations in which the insurance will not be put into play if there is damage done to others. These situations are referred to as contractual warranty exclusions.

More specifically, liability insurance will not be used if the damage was done intentionally or if it was caused to you or your loved ones (the latter not being considered as third parties). Apart from that, it can not be used for professional damage. To be covered, independent professionals (independent employees, company managers, etc.) must take out specific insurance: professional liability insurance. With regard to employees, they are covered by the professional liability of their company.

How to terminate the borrower insurance with the bank?

In order to validate your credit application, your bank will systematically ask you to subscribe to a borrower insurance . But if this type of contract is often very comprehensive and easy to conclude, it is both expensive and not very customizable. If you have already subscribed to the contract proposed by your bank, know that it is possible to terminate the insurance borrower , but you must take the right way. So, how to proceed with the termination of a current home loan insurance with the bank? This is what we will see together in the lines below.

Terminate your borrower insurance during the year

If you concluded your borrower insurance contract less than a year ago, the Hamon law of 2014 allows you to proceed to the cancellation of the borrower insurance in favor of a more interesting contract (right of substitution during the first year). This law was put in place to promote competition between the different lenders and allow borrowers to enjoy more advantageous rates.

To terminate the borrower insurance contract you have with your bank, simply send a letter with a copy of your new policy. In addition, you must respect 15 days notice. You have the option to take the steps yourself or use the services of an insurance broker.

Take advantage of the device put in place by the Bourquin law

Coming into force since 2017, the Bourquin law , also known as the Sapin 2 law , gives borrowers the possibility of canceling their loan insurance contracts each year. This scheme was introduced with the aim of giving borrowers a means to negotiate their insurance contributions at the time of the conclusion of the loan. He then comes to modify a market long dominated by the group contracts proposed by the banks.

To exercise your right, you must inform your bank no later than 2 months before the anniversary date of your policy . You will also need to obtain its authorization and agreement on the equivalence of guarantees before you can enter into a new contract. As for the procedure itself, you must send 2 letters to your bank.

- One will be on the request for an agreement in principle on the equivalence of guarantees;

- The other on the final validation request and the termination of the contract that binds you with the bank . You will only be able to join a new contract once you have received the agreement in principle from your bank.

Cases of refusal of the bank

For various reasons, the bank may refuse the substitution of the borrower insurance contract . This is what will happen when the new contract guarantees are lower than your current contract. In principle, in this case, the bank will inform you by specifying the reason for its decision. If you want to challenge this decision, make a complaint to the director of the agency.

If the latter does not answer you within 2 months after your request, take your case to the Prudential Supervisory Authority. If the amount of your contributions exceeds 10,000 euros, you will have to take legal action against your bank. Finally, if your bank simply does not respond to your request for contract substitution, there may be a problem with your file .

To completely complete the subject, it should also be noted that the termination of the borrower insurance is not always easy to implement a technical point of view. Take it well in advance to achieve it, it’s much better, especially after more than a year of bank loan.

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

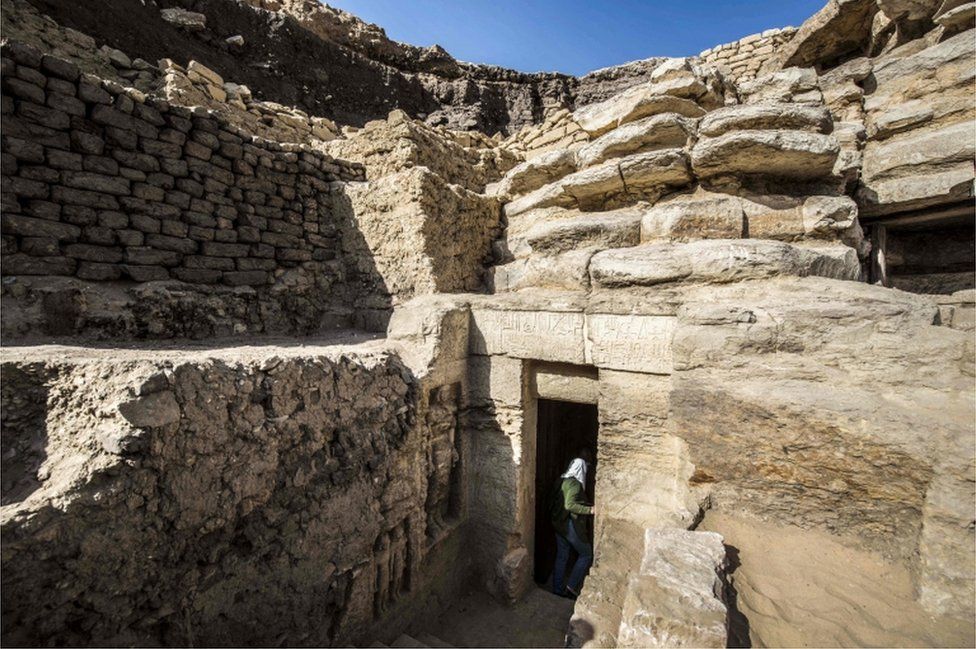

Stunning pictures show inside of 4,000-year-old ancient Egyptian tomb

The tomb, close Saqqara, a tremendous necropolis south of Cairo, had a place with a senior authority named Khuwy

He is accepted to have been an aristocrat amid the Fifth Dynasty, which controlled over Egypt around 4,300 years back

In a noteworthy archeological revelation, Egypt on Saturday uncovered the tomb of a Fifth Dynasty official decorated with brilliant reliefs and all around saved engravings.

The tomb, close Saqqara, a tremendous necropolis south of Cairo, had a place with a senior authority named Khuwy who is accepted to have been an aristocrat amid the Fifth Dynasty, which controlled over Egypt around 4,300 years back.

Mohamed Mujahid, leader of the Egyptian mission which found the tomb of the antiquated Egyptian aristocrat “Khewi”, takes a selfie. The tomb at the Saqqara necropolis goes back to the fifth administration (2494-2345 BC). Photograph: AFPMohamed Mujahid, leader of the Egyptian mission which found the tomb of the old Egyptian aristocrat “Khewi”, takes a selfie. The tomb at the Saqqara necropolis goes back to the fifth administration (2494-2345 BC). Photograph: AFP

Mohamed Mujahid, leader of the Egyptian mission which found the tomb of the antiquated Egyptian aristocrat “Khewi”, takes a selfie. The tomb at the Saqqara necropolis goes back to the fifth administration (2494-2345 BC). Photograph: AFP

In a noteworthy archeological disclosure, Egypt on Saturday revealed the tomb of a Fifth Dynasty official enhanced with bright reliefs and very much safeguarded engravings.

The tomb, close Saqqara, a huge necropolis south of Cairo, had a place with a senior authority named Khuwy who is accepted to have been an aristocrat amid the Fifth Dynasty, which managed over Egypt around 4,300 years prior.

Offer:

“The L-molded Khuwy tomb begins with a little hallway heading downwards into a waiting room and from that point a bigger chamber with painted reliefs portraying the tomb proprietor situated at a contributions table,” said Mohamed Megahed, the exhuming group’s head, in an ancient pieces service articulation.

Flanked by many represetatives, Antiquities Minister Khaled al-Enani said the tomb was found a month ago.

Lavish works of art brag an uncommon green sap all through and oils utilized in the internment procedure, the service said.

The tomb’s north divider demonstrates that its plan was motivated by the compositional outline of the tradition’s imperial pyramids, the announcement included.

Egypt tomb: Saqqara ‘one of a kind’ discovery revealed

Archaeologists in Egypt have made an exciting tomb discovery – the final resting place of a high priest, untouched for 4,400 years.

Mostafa Waziri, secretary-general of the Supreme Council of Antiquities, described the find as “one of a kind in the last decades”.

The tomb, found in the Saqqara pyramid complex near Cairo, is filled with colourful hieroglyphs and statues of pharaohs. Decorative scenes show the owner, a royal priest named Wahtye, with his mother, wife and other relatives.

Archaeologists will start excavating the tomb on 16 December, and expect more discoveries to follow – including the owner’s sarcophagus.

Egyptian mummification ‘recipe’ revealed

Cat mummies discovered in Egypt tombs

Here’s what they’ve found already…

Earliest Ancient Egyptian Tattoos Found on Mummies

Old EGYPTIANS WERE getting inked up sooner than we suspected.

Another examination of two mummies demonstrates the pair were wearing tattoos. The mummies have a place with a gathering of six found in 1900. They were named the Gebelein mummies after the district in which they were found. Presently in the ownership of the British Museum, they were reanalyzed as a component of a continuous undertaking to reevaluate important ancient rarities.

The two people date somewhere in the range of 3351 B.C. to 3017 B.C., making them probably the most punctual known bearers of tattoos. The following known case of antiquated Egyptians getting tattoos doesn’t show up for over a centuries later.

Just Ötzi the Ice Man, a cave dweller going back to around 3370 B.C., has prior proof of tattoos.

In contrast to Ötzi’s tattoos, which have progressively geometric structures, the Egyptian tattoos are the soonest known instances of allegorical tattoos, or tattoos that speak to pictures. The new discoveries are distributed in the Journal of Archeological Science.

What at first resembled a smear was reconsidered with infrared imaging, which enables researchers to see the markings on the embalmed skin with greater clearness. On the male body, researchers recognized the pictures of a wild bull and what seems, by all accounts, to be a Barbary sheep.

The lady’s body contains four “S”- like images on her top shoulder joint and a “L”- formed line on her midriff that archeologists think may be a fight, or wooden staff.

The two bodies contained tattoos that were inked into the dermis, the thicker piece of their skin, with an ink made of a type of ash. Copper instruments found in adjacent districts have been recently proposed as inking apparatuses.

What the Tattoos Tell Us

The find proposes, out of the blue, that the two people in antiquated Egyptian social orders had tattoos.

Already, archeologists expected that just ladies living amid antiquated Egypt’s predynastic period, from 4000 B.C. to 3100 B.C., had tattoos. This hypothesis depended on dolls that delineated ladies with tattoos.

These tattoos speak to the first run through archeologists have discovered instances of tattoos on individuals that reflect themes utilized in craftsmanship.

Both the pictures on the male and female appear to recommend an emblematic pertinence, however archeologists aren’t exactly of their accurate importance.

“The sheep is usually utilized in the predynastic [Egyptian period] and its essentialness isn’t surely knew, though the bull is explicitly to do with male virility and status,” says think about creator and British Museum guardian Daniel Antoine.

Fx empire natural gas

The hydrocarbon-based natural gas from the fossil fuels group is found in the form of large volumes of gas, trapped in the cavities of porous rocks underground or above the oil beds.

Natural gas; It is a colorless, odorless and airless gas consisting of 95% methane, small amounts of ethane, propane atom, butane and carbon dioxide. Since natural gas is odorless, it is specially scented for detecting leaks. For this purpose, THT (tetra hydro theophen) and / or TBM (tertiary butyl mercaptan) are used. Methane gas, which is 95% or higher in the mixture, is characterized by having the simplest chemical structure fx empire natural gas and the lowest carbon content. The methane molecule consists of 1 carbon 4 hydrogen atoms.

Because of its simple chemical structure, combustion is easy and full combustion takes place. , Which therefore; does not generate smoke, soot, soot, and ash. It is the fuel that is most easily adjusted and has the highest combustion efficiency. This feature provides ease of use and economy. Due to the low carbon content, the emission of carbon dioxide gas, which creates a greenhouse effect in the atmosphere and is toxic to human health, is 1/3 of solid fuels and 1/2 of liquid fuels.

The presence of natural gas in Turkey in 1970 were identified in Kırklareli Institutions, Pınarhisar in 1976 began to be used in cement Fabrikası`N. In 1975, the natural gas in the Mardin Çamurlu area was given to the Mardin Cement Factory in 1982. The limited reserves in resources prevented the expansion of consumption.

The work on the use of natural gas in industrial and urban networks began after the agreement on natural gas shipment signed with the USSR in 1984 with the decision of the Council of Ministers numbered 84/8806. Natural gas was first used in Ankara in 1988 as domestic and commercial in the city. In 1992, the natural gas market expanded in Istanbul, Bursa, Eskisehir and Izmit.

It presented the annual natural gas consumption in Turkey amount of the agreements signed in 2005 with 40 billion cubic meters; It is expected to reach 55 billion m³ in 2010. There is no risk of cutting natural gas especially in domestic use. Most of the gas is used in the industry, and gas distribution companies make a special contract with their subscribers in the industry to reduce the amount of gas it gives to the industry in case of a shortage of gas supply and give it to the houses. Such a situation is unlikely today because

gas supply is more than demand in our country.

In Turkey it is also provided in the exit gas and a limited amount of use. Turkey natural gas pipeline from the mainly Russia and Iran, Algeria and Nijerya` from liquefied (LNG) by sea to buy as is. It has also concluded agreements fx empire natural gas with Azerbaijan and Turkmenistan for the supply of natural gas.

Turkey, is shown by energy experts as one of the world’s fastest growing on the market. Economic growth and limited natural resources increase the energy import requirement of our country. Turkey is a bridge between the Middle East and the Caspian Sea due to the strategic location and natural gas production areas in the European consumer market.